Financial Analysis for a Changed World

Our expertise lies in identifying and analysing the impact on investment value that the climate crisis is already exerting, and how this is likely to play out over longer time horizons.

Our Analysis

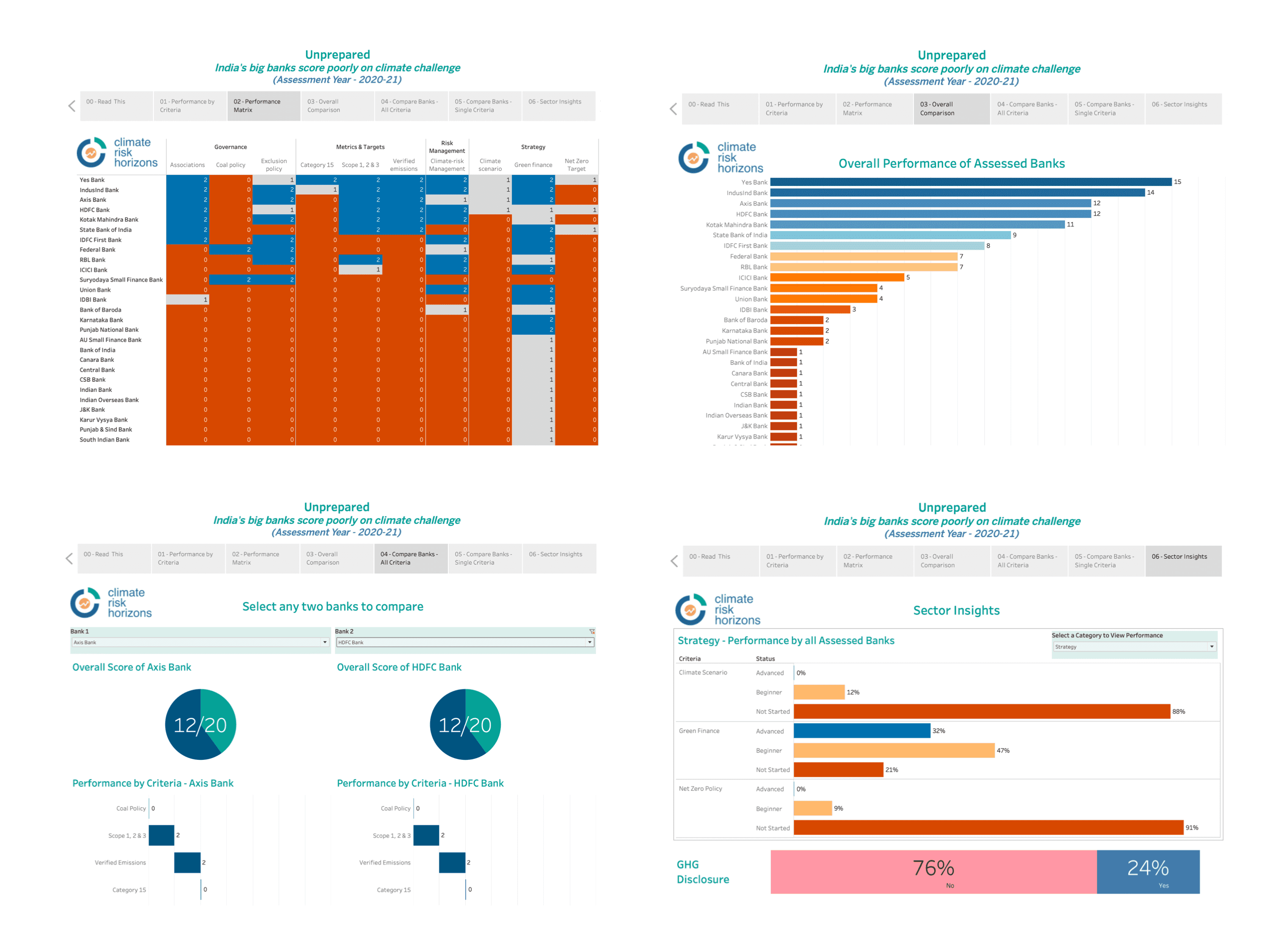

Data Dashboards

Climate Risk Preparedness Among India's Largest Asset Management Companies

Indian Asset Management Companies (AMCs) are entrusted to manage billions of rupees in mutual funds. As climate risks worsen, the financial risks to their portfolios mount. This dashboard by Climate Risk Horizons assesses the climate preparedness of India's top 12 AMCs. Each AMC is scored on ten climate indicators based on publicly available information.

VIEW ALL

Blog

VIEW ALL

Coal to clean: Banks need to step up support for India’s energy transition

Indian banks need better policies to support India’s energy transition

READ MORE

Why Indian Banks are Falling Behind in the Sustainable Finance Race

India’s banks must act now to lead the country’s low-carbon transition.

READ MORE

India’s Carbon Market Needs More than Good Intentions to Succeed

India’s carbon market holds immense potential, but systemic flaws and unaddressed challenges risk turning a climate solution into a greenwashing facade.

READ MORE

WHAT WE BELIEVE

Financial stability is dependent on ecosystem stability.

The climate crisis poses threats to both financial and environmental systems. These threats arise directly from climate change itself, and indirectly from changes in the socio-political economy that are propelled by the climate crisis.

Given the over-arching nature of climate change impacts, risks manifest in varying ways, from changing physical conditions due to altered weather patterns to evolving policies impacts and the loss of social license for industries that were once considered foundations of the economy.

OUR TEAM

Ashish Fernandes

Director & Lead Analyst

Ashish Fernandes

Director & Lead Analyst

Ashish has over two decades of international experience in the ESG sphere. He believes that the financial sector is not prepared to mitigate the value destruction that will accompany rapid climate change and associated environmental & social upheaval. Ashish is an alumnus of St. Xavier’s College, Mumbai, where he studied Economics.

Harshit Sharma

Lead Researcher

Harshit Sharma

Lead Researcher

Harshit has research experience on air pollution and the power sector, particularly on coal and related environmental issues. He strives to use his research and analytical skills to bring regulatory and policy changes favourable for a smoother and faster energy transition. Harshit holds a Master’s degree in Conflict Management and Development and is based in Delhi.

Sagar Asapur

Sustainable Finance

Sagar Asapur

Sustainable Finance

Sagar is a post-graduate in Carbon Finance from University of Edinburgh Business School, UK, with over a decade of experience in the environmental sector. He believes that the financial industry can have a positive impact in the societies and economies for a sustainable future.

Vishnu Teja

Energy Researcher

Vishnu Teja

Energy Researcher

Vishnu has 6+ years of experience in the field of data analytics and holds a Master's degree in Environmental and Resource Management, from TU Freiberg, Germany. He seeks to use the power of data to understand how India can develop a sustainable and economically viable climate change mitigation plan.

Divya Chirayath

Communications

Divya Chirayath

Communications

Divya has research and communications experience in the think tank sector and has worked at prestigious institutes such as TERI and the Barefoot College.

Anusha Das

Analyst, Sustainable Finance

Anusha Das

Analyst, Sustainable Finance

Anusha did her undergraduate studies in economics from Presidency University, Kolkata and worked as a Statistical Officer for the Government of India where she analyzed India's energy sector. This ignited her passion for climate action, leading her to study Public Policy at NLSIU, Bangalore. With her experience with economic frameworks, Anusha aims to explore innovative metrics that incorporate climate realities and help drive greener decision making.

Arundhati Muthu

Analyst, Sustainable Finance

Arundhati Muthu

Analyst, Sustainable Finance

Arundhati has over a decade of experience working on environmental issues with a focus on climate change and India’s energy transition. Her current focus is to produce research and analysis that supports financial actors in India in moving towards sustainability at the pace and scale required to address the climate crisis. She has an undergraduate degree in Physics and a Masters degree in Computer Science.

Ritaj Kalaskar

Research analyst

Ritaj Kalaskar

Research analyst

Ritaj has an interdisciplinary background in urban studies, international affairs, world history, economics and literature. He has worked in a range of projects from affordable housing, low-carbon construction, ecological restoration and environmental planning at Auroville. He completed his postgraduate studies from the Indian Institute for Human Settlements where he focused on energy transitions, urban infrastructure and climate policy.

Rakesh Ranjan

Consultant

Rakesh Ranjan

Consultant

Dr. Rakesh Ranjan Kumar is an Economist with a PhD in Development Studies from Jawaharlal Nehru University, Delhi. He also has an MPhil in Development Economics. He has taught undergraduate courses at a number of Universities across India and has extensive research experience in the development sector. His current research focus is on the Green Transition and Public Policy.

Get in Touch

Climate Risk Horizons,

c/o WeWork,

Site No. 26, Laskar Hosur Road,

Adugodi, Bengaluru, Karnataka,

560029